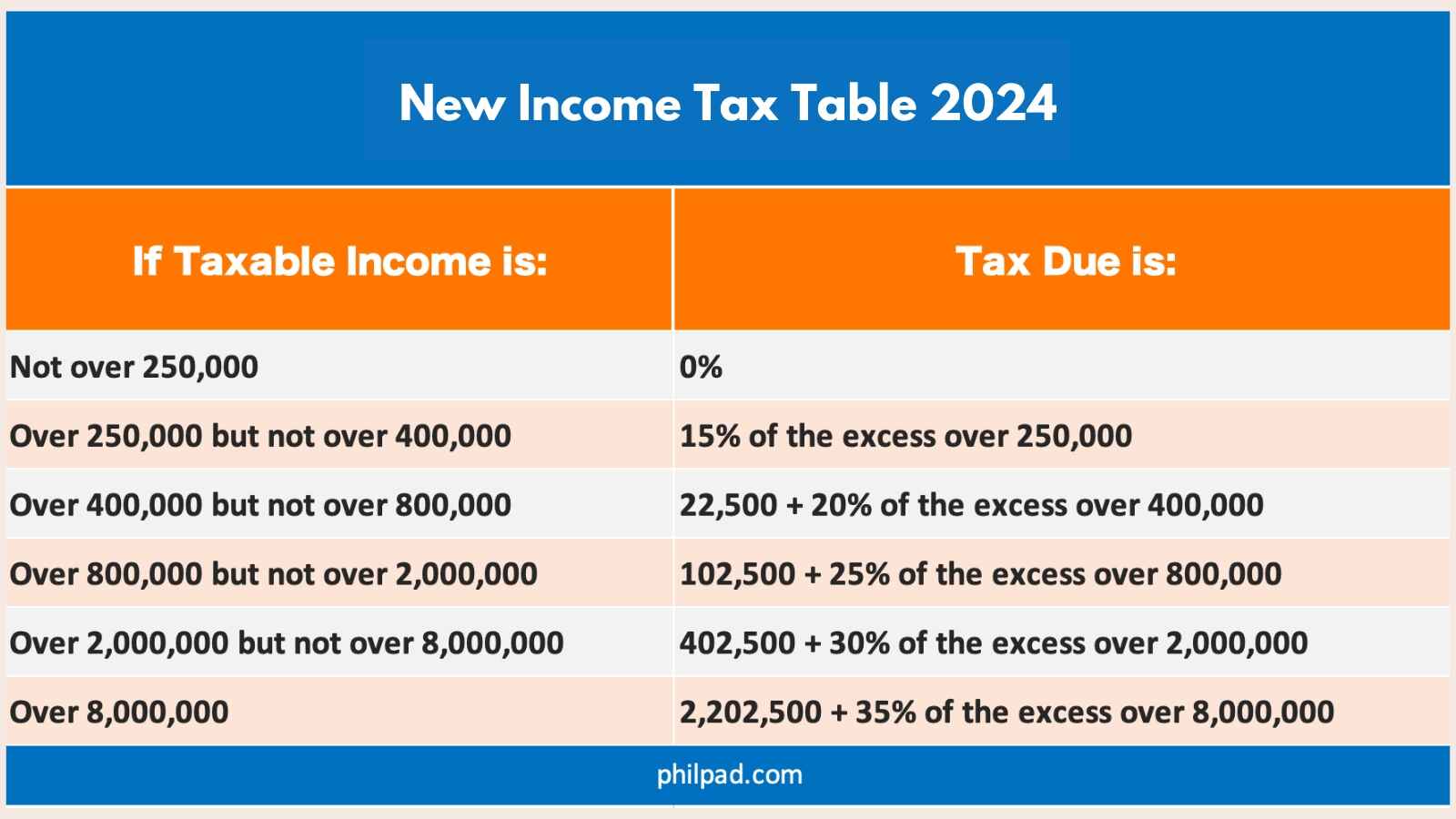

Withholding Tax Brackets 2025 Philippines. Use the bir tax table in 2025 to determine the tax rate applicable to your taxable income. Discover the philippines tax tables for 2025, including tax rates and income thresholds.

Income over php 250,000 up to php 400,000: It is determined by your taxable income and based on the graduated tax rates set by the bureau of internal revenue (bir).

Withholding Tax Calculator 2025 Philippines Betta Charlot, Easily determine accurate withholding tax amounts for salaries, services, and other income types.

Tax Bracket Philippines 2025 Anya Dianemarie, The package two of train law is still in effect, which is using the withholding tax table 2025.

Withholding Tax Calculator 2025 Philippines Jania Lisetta, 1, 2025, revised individual income tax rates will take effect.

Annual Withholding Tax On Compensation Table Philippines, Just enter your gross income and the tool quickly calculates your net pay after taxes and deductions.

Taxable per Year, Get familiar with the philippine income tax table for 2025 and know your tax bracket, the amount owed, and how to compute your tax dues.

2025 Tax Brackets And Deductions Cody Mercie, In the philippines, withholding tax on salaries is computed based on graduated tax rates set by the bir.

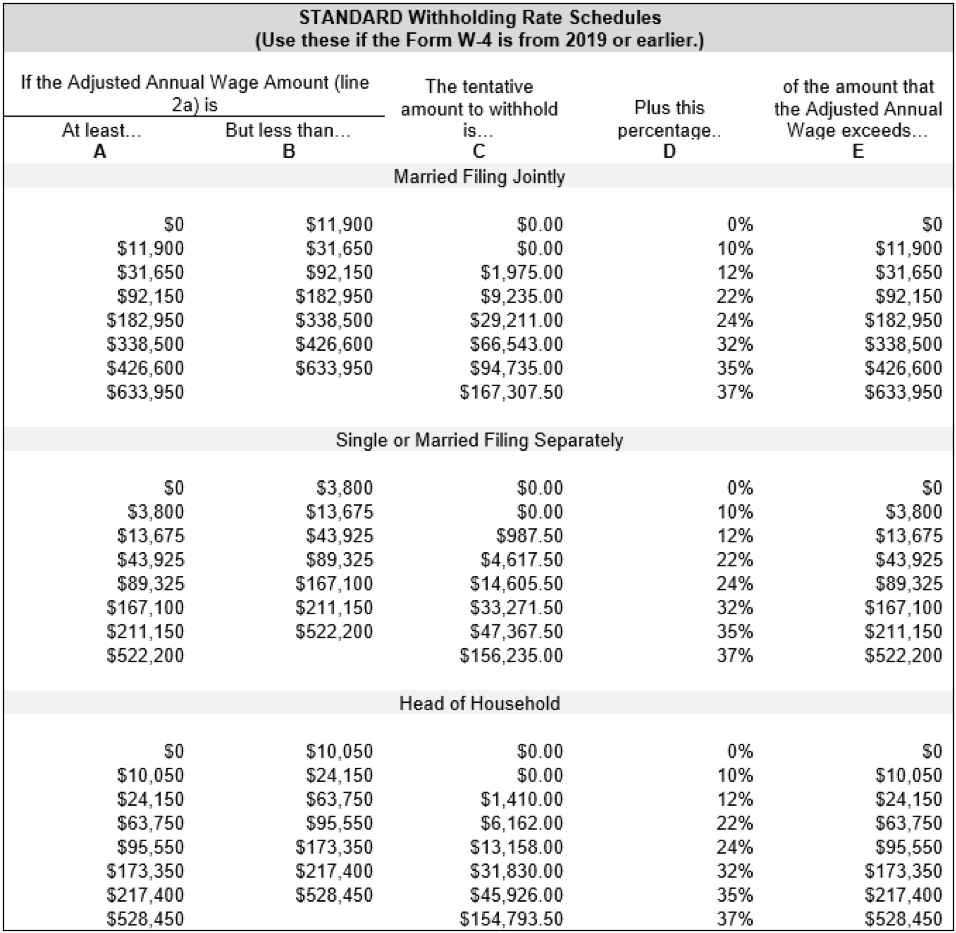

2025 Federal Tax Bracket Clem Melita, Easily determine accurate withholding tax amounts for salaries, services, and other income types.

Canada 2025 And 2025 Tax Rates & Tax Brackets Lacey Jessika, The package two of train law is still in effect, which is using the withholding tax table 2025.